Too many GTM efforts in B2B companies are focused on leads and pipeline creation, causing them to wonder why that doesn’t work well for them. Outcomes are unpredictable and the marketing and sales teams are badly aligned. That’s why in my blog post “Modern Demand Management,” I proposed a “VAP” (value-added pipeline) approach for B2B marketers that is a function of the ending pipeline and the total bookings or ARR in a given quarter. In this strategy, marketing is focused on managing six elements of pipeline: starting pipeline, new pipeline, pipeline value change, closed won opportunities, closed lost opportunities and ending pipeline.

VAP was pioneered by and put to work at Palo Alto Networks, where I worked as chief marketing officer for more than a decade, flipping the traditional way of looking at marketing pipeline on its head. Its purpose, ideally, is to create perfect alignment between sales and marketing in that there is one target, one win rate, and one pipeline target number — but also, and even more importantly, to align GTM strategy and tactics with overall, corporate financial goals.

In this post, I will elaborate on how we did this and offer practical implementation ideas.

Rethinking the Role of Marketing in the Pipeline Process

Across the software industry, I observed that many (if not most) marketing efforts solely focused on the creation of new pipeline based on short-term goals. Even the teams within marketing were called “DG” (shorthand for demand generation), and their metrics were highly focused on driving pre-acquisition interactions (form-fills, downloads) rather than overall pipeline growth, acceleration and successful closure.

To me, this presented an opportunity: Can we stop fueling an unoptimized pipeline model and radically rethink the role of marketing in the pipeline process? From the start at Palo Alto Networks, we believed that marketing was responsible for getting to 100% of the company’s pipeline targets. But what exactly were those targets, and how deep inside the pipeline does marketing continue to be relevant and augmentative? After all, in most companies we observed, the pipeline was almost exclusively controlled by sales.

The idea was born to reverse the thinking: How do we get to the starting point if we start with the desired outcome?

The Six Elements of Pipeline

Clearly, the desired outcome is to get to 100% of the quarterly pipeline target – and not just this quarter, but also the next three. This is especially important in organizations that have elongated (six- to nine-month) sales cycles that are negotiated. The sales-cycle length changes how we calculate targets, starting with the size of the ending pipeline. The negotiated nature of the deals causes deal value changes during the sales cycle.

While this post isn’t about conversion metrics per se, it is important to mention that those metrics play a key role in calculating the pipeline targets. For our purposes here, I will assume that those calculations underlie the targets.

That brings us to how we start the model: at the end. When we plan a quarter, we know the following three elements of the pipeline since they are locked into the financial plan for the year or are observable in the opportunity-management system:

- The starting pipeline: The totality of the pipeline available on the first day of the quarter. It has two elements: pipeline for opportunities that are set to close this quarter and pipeline for opportunities that are set to close in the three quarters after this one. It is best practice not to consider opportunities that are set to close farther out, or to exclude opportunities that aren’t fully documented yet in the CRM system.

- The closed–won opportunities: The target closed business for the current quarter as per the plan.

- The ending pipeline: The target pipeline needed to continue to achieve the plan targets.

This leaves three more elements for which we need to model and plan:

- The new pipeline: The totality of new opportunities created this quarter for the current quarter plus the three following quarters.

- The pipeline value change: The value change of opportunities in the quarter.

- The closed lost opportunities: The opportunities that are lost in the quarter.

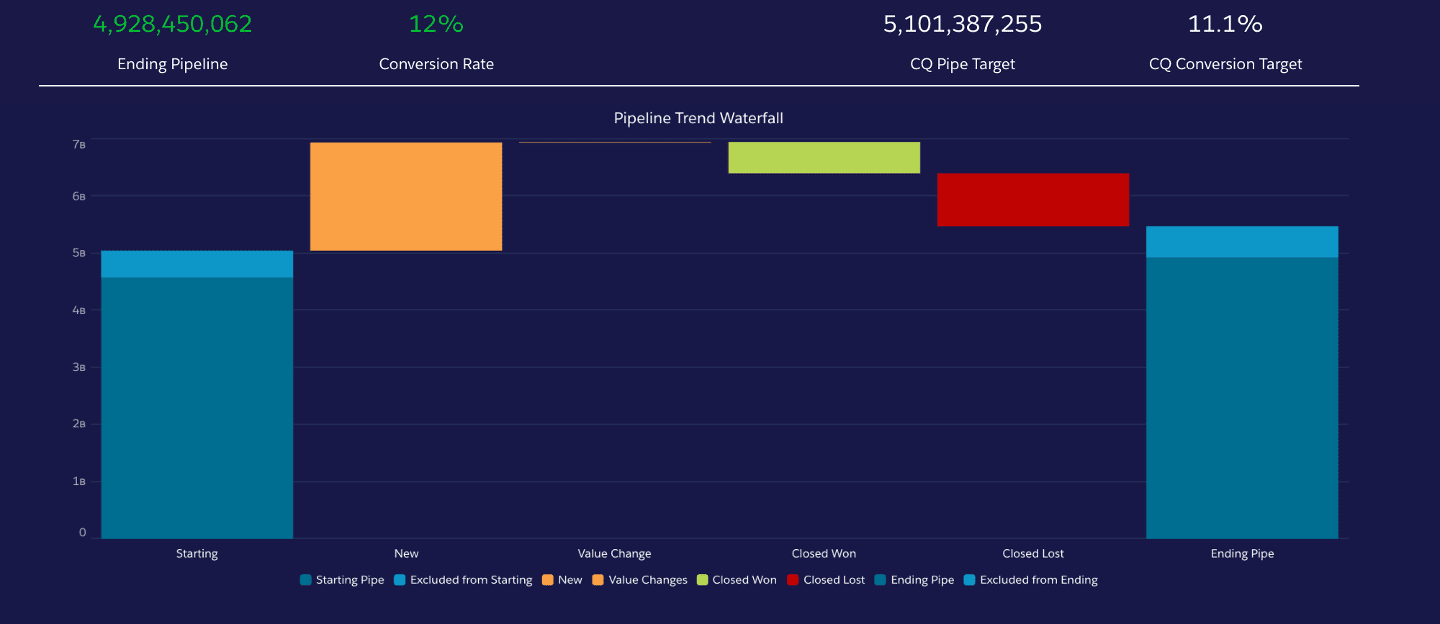

Here’s what that looks like:

(Source: Palo Alto Networks)

From this waterfall diagram, taken from a real company, one can derive a great number of objectives and metrics that are linked to the financial plan and in-quarter operations.

How to set goals in this approach is based on the maturity of the GTM organization. In my experience, most organizations start with an approach that focuses on ARR targets and pipeline creation. While not wrong, it’s woefully simplistic and may lead to a marketing strategy that will rapidly start to disconnect from the sales strategy and the financial plan.

Let’s elaborate:

The simple calculation is 3-2-1=4.

The elaborate one is 3-2-1-6-5=4. (note that 5 might be a negative number)

In the simple case, marketing will focus on creation goals only and become disconnected from the pipeline lifecycle. In my experience, this categorically leads to two issues: a declining conversion rate of newly created pipeline and a declining effectiveness (yield) of the marketing budget related to pipeline generation.

The elaborate case forces marketing to take into account the pipeline lifecycle and, specifically, the effect of added interactions and time on the value of opportunities, their duration to close and their propensity to get closed.

Let’s take the example of opportunity value. In early-stage GTM organizations, I observe that once an opportunity is created, marketing passes the baton to sales and focuses on creating more new pipeline. In more mature organizations, marketing continues to work – alongside sales, of course – on creating more value by taking actions that convince the prospective customer to buy more of the product or buy options they hadn’t considered before (I often call this “supersizing”).

Similarly, actions are developed to prevent the prospective customer from buying less, such as stepping down a tier or shrinking the use case. These value-driven marketing actions are far more driven by context, content and reference than typical pipeline-generation activities that are more promotional in nature.

Additionally, let’s look at opportunity close propensity. Marketing’s role in this in mature GTM organizations is quite significant. Core elements are reference and hospitality programs, competitive analysis and rebuttal activities. These activities are very focused and specific but carry elements that can work across multiple opportunities.

The latter actually goes to the heart of the matter as to why even more mature GTM organizations aren’t following this value-added pipeline approach. The common idea, or should I say philosophy, is that scaling means that marketing needs to focus on volume and that there is a natural handoff between marketing and sales, implying that marketing only needs to focus on the “top of the pipeline” and that sales focuses on its value. I recommend never to let it come to that, because once a GTM organization is set up this way, it’s exceedingly hard to change it afterward.

I, for one, do not believe it’s a maturity argument. At its core, it’s an effectiveness argument; hence, it can start at the genesis of a GTM organization. We saw great positive effects of this approach at Palo Alto Networks, starting with a very tight relationship between the marketing and sales organization. However, its biggest impact was on the effectiveness of marketing spending and pipeline predictability, which in turn greatly impacted the cost of customer acquisition and revenue growth.

Conclusion

A value-added pipeline approach yields higher opportunity close rates, lower marketing demand and customer acquisition costs and tighter alignment in the GTM organization – at any stage and at any size.

The information contained herein is based solely on the opinion of René Bonvanie and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

The information and data are as of the publication date unless otherwise noted. Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

A monthly newsletter to share new ideas, insights and introductions to help entrepreneurs grow their businesses.