In evaluating what type of go-to-market approach to use in introducing a new SaaS product to potential buyers, a founder likely will look closely at whether product-led growth (PLG) is the most effective strategy. If that’s the choice, a founder will then have to decide between two PLG pricing models: free trial and freemium.

In this blog post, we will examine both models and offer real-world use case examples. We’ll also analyze key factors that can guide founders in deciding between free-trial or freemium pricing, ensuring that the decision aligns with a company’s goals and market dynamics.

The Case for a Freemium Pricing Model

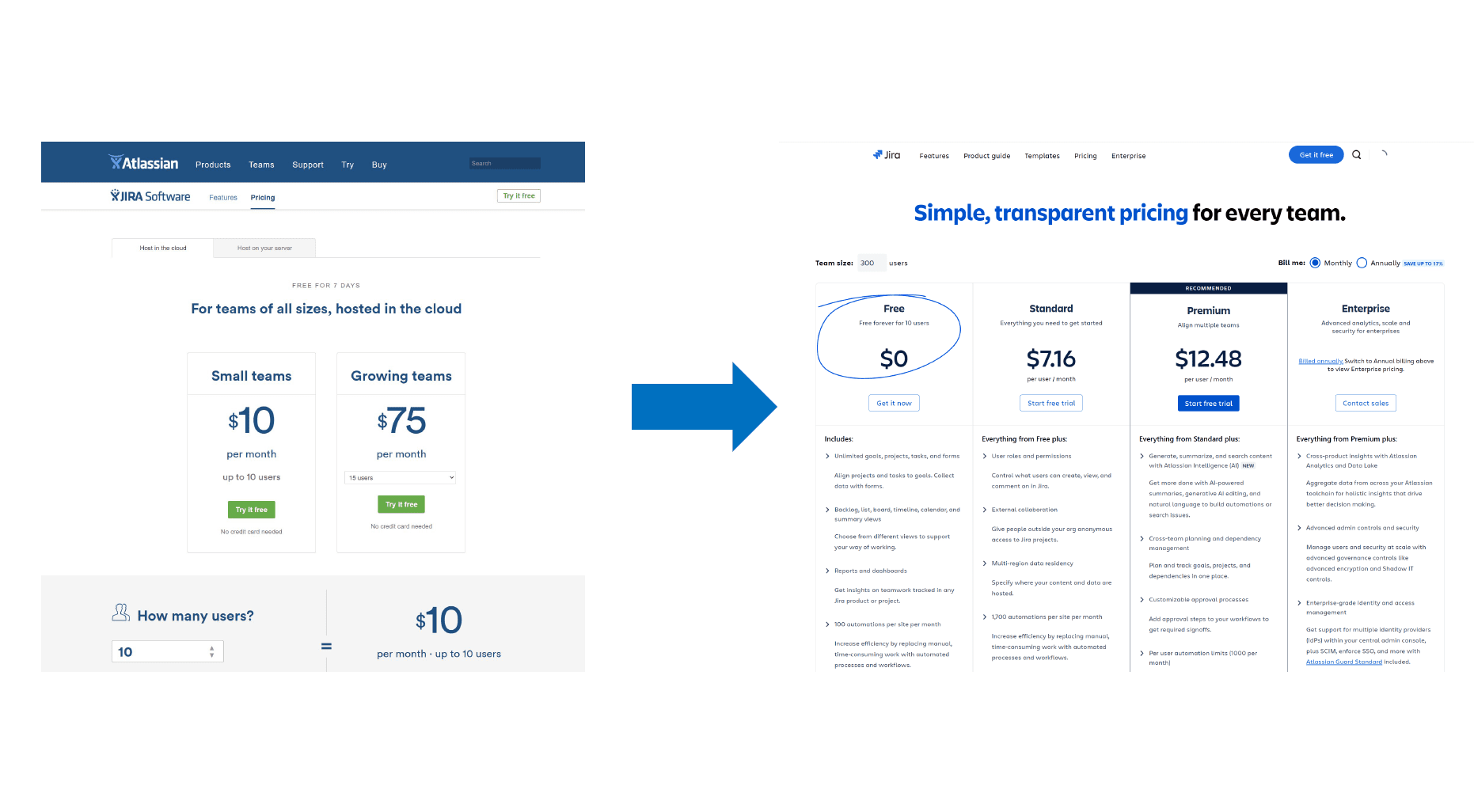

You may be familiar with Atlassian, the maker of developer-collaboration software like Jira, Confluence and Trello. Seven years ago, Atlassian launched Stride, a team chat product, to compete with Slack. At that time, Slack was a four-year-old product, growing quickly but nowhere close to being a category leader. Atlassian already had previous products with an existing customer base of over 100,000 – a substantial distribution advantage. So, they saw the opportunity to take on Slack with Stride, pricing it attractively at $2 per user/month. The price point, already considered fairly inexpensive for an enterprise-software product, also came with a 30-day free trial, allowing customers to start for free and either pay or leave after the trial period.

Slack, on the other hand, was 4x as expensive as Stride, with pricing plans that started at $8 per user/month and went up to $15 per user/month. Slack also had a “forever” freemium plan ($0 per user/month), but it came with a limited feature set. The basic plan was sticky, allowing Slack to capture customers for life and, eventually, get them to upgrade to a paid plan.

After a tough two-year market battle, Atlassian’s free-trial approach lost out to Slack’s freemium model and eventually sold the Stride business to Slack. Scott Farquhar, CEO of Atlassian, recently shared on a podcast that Stride had a better product than Slack and was priced much cheaper but ultimately lost the battle. Why? Slack’s freemium plan costs nothing and supports unlimited users, even though it maintains gated features such as search, message history, and others.

Atlassian learned a lesson here: given a choice, customers often opt for freemium over free trial, even if they will eventually have to pay a price for more functionality. Many customers don’t require the extra, paid features and can function just fine on the free, basic option. The company then eventually shifted their GTM strategy from free trial to freemium, launching free tiers for all their cloud products in 2019.

The Case for a Free-Trial Pricing Model

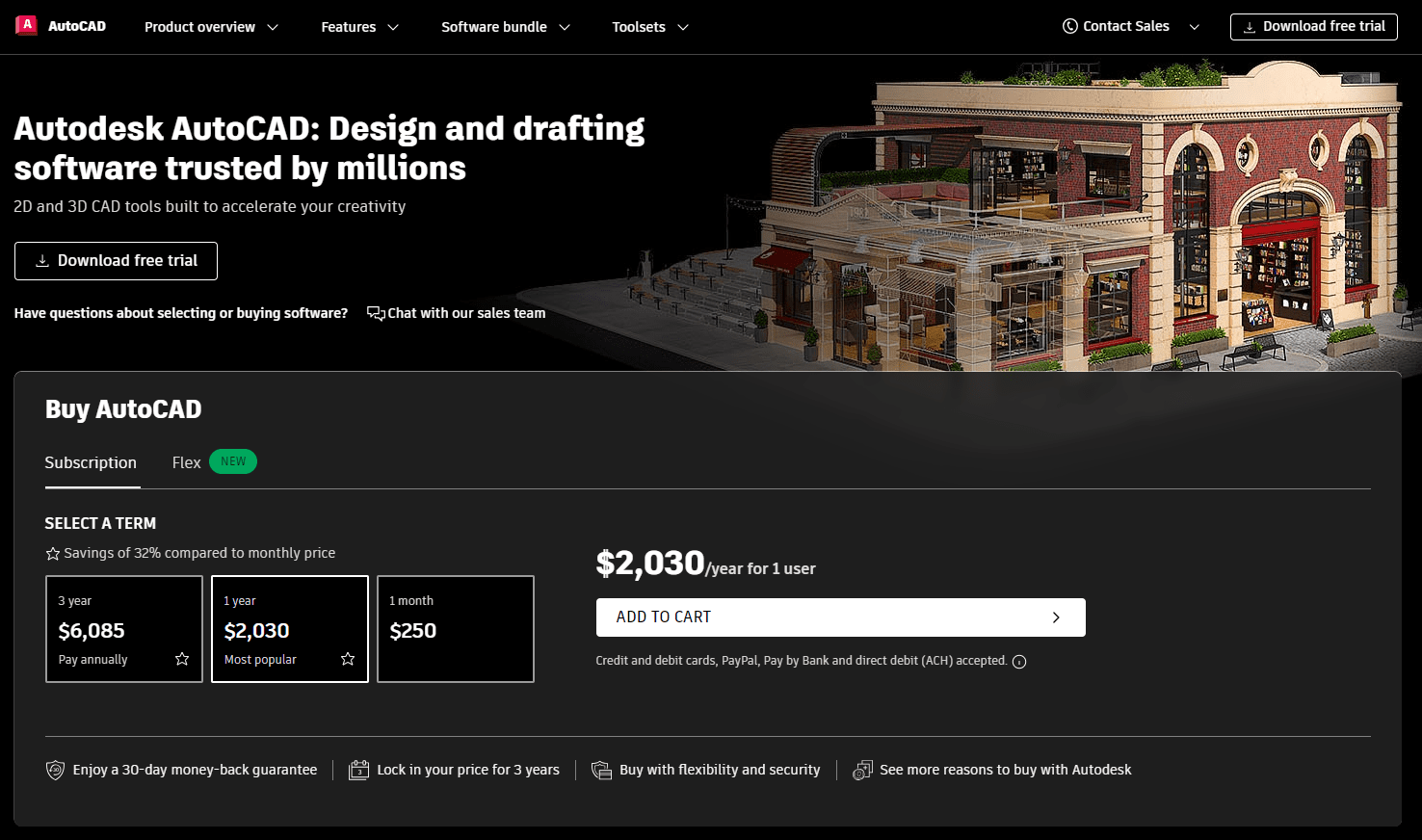

Moving entirely from free trial to freemium is not a slam-dunk decision, however. And it’s not the perfect answer for all companies. For example, Autodesk, a highly successful SaaS provider, thrived under a free-trial strategy, although it took a much longer time for the process to grow the company.

Autodesk, designed for industrial designers, architects and graphic designers, has successfully built a $5 billion business over a span of 40 years, primarily through seat-based licensing. Distinct from competitors like Canva or Adobe, Autodesk opted against a freemium model, choosing instead to offer a 15-day free trial, followed by monthly or annual subscriptions. By sustaining a substantial price point ($250 per user per month) and catering to a relatively limited market (a few million users), Autodesk has effectively captured significant market share within its segment.

Autodesk’s ability to thrive with a free-trial model can be attributed to several key factors. First, the specialized and high-value nature of its software justifies a higher price point, making a freemium model less practical. The complexity and advanced feature set of Autodesk’s products often requires a significant investment in time to learn and integrate into existing workflows, which aligns well with a free-trial approach that allows users to fully experience the software’s capabilities before committing to a purchase. Additionally, Autodesk’s target market of professional designers and architects is accustomed to investing in premium tools that deliver substantial value, making them more likely to transition from a trial to a paid subscription. This targeted approach ensures that Autodesk can maintain high revenue per user while effectively serving its niche market.

Freemium vs. Free-Trial: How to Decide

Both pricing models have their merits, depending on a business’s industry and goals. Here are several of the factors to consider in deciding your own pricing model:

Total Addressable Market (TAM): Finite vs. Large

For a freemium model to succeed, a company needs a large TAM. When a company gives away a product for free, many users will find workarounds to remain on a free plan and not upgrade to a paid subscription. You’ll need a substantial user base to secure enough paying users. By contrast, if you have a smaller, but more dedicated, market, you may see more success with a free-trial model, as did Autodesk.

Business Goal: User Base vs. Revenue

A freemium approach is a better fit for companies with the primary goal of attracting as many users as possible, since it is likely many will opt to remain on the free plan. The potential for these users to upgrade to a paid plan depends on the attractiveness of premium features and the price point – and it’s not guaranteed. This approach is effective for building a substantial user base and generating revenue from a smaller segment of that base. On the other hand, a free-trial approach targets more serious potential customers by offering a time-limited opportunity (15-30 days, typically) to try the product before making a purchase decision. By focusing on users who are more likely to pay, a free-trial approach deprioritizes more casual users to facilitate a quicker transition from trial to paid customer.

Price Point: High vs. Low

Pricing for subscription software varies widely, anywhere between $10 to $1,000 per user per month, with variability stemming from a product’s value proposition and users’ willingness to pay. A freemium strategy typically is most effective at a lower price point – between $10-50 per month – at which individual users can easily manage expenses and seek employer reimbursement. At this price point, users are more likely to seek out and purchase the software themselves without requiring a hands-on sales process. Conversely, selling higher-priced software will often require human interaction to build trust with buyers, understand prospective users’ pain points, effectively communicate a product’s value proposition and aid in implementation. This hands-on approach is crucial to justify the higher cost and ensure successful adoption and integration of the software.

Cost of Goods Sold (COGS): High vs. Low

COGS, in the context of software/SaaS products, refers to the direct costs associated with delivering the software to customers. This includes expenses like hosting fees, third-party software licensing, customer support and maintenance costs. COGS is a significant, often overlooked, factor in software pricing decisions. Historically, best-in-class software companies have kept their COGS low, achieving gross margins of 80% or higher, which enables them to offer portions of their product for free, leveraging the profits from paying customers to sustain their freemium model. Conversely, if you’re running a SaaS business with high COGS (40% or more), the freemium pricing strategy may not be feasible. This explains why data and compute-intensive software and the recent wave of generative AI applications often favor a free-trial strategy over freemium.

Product: Simple vs. Complex

The complexity of a software product is a crucial factor to consider in determining the appropriate pricing strategy. User-friendly tools like Calendly or Dropbox benefit from both a large TAM and simplicity of use, which allow users to quickly realize value. Products with a more complex setup and implementation process, like customer-support tool Zendesk, are better matched with a free-trial strategy. By limiting the trial period (e.g., to 30 days), Zendesk targets serious potential customers and creates a sense of urgency to complete the onboarding process within that time frame. This approach can be enhanced by providing additional sales and support resources to assist customers during the trial, thereby improving the conversion rate from free to paid users.

Competitive Landscape: Blue Ocean vs Red Ocean

In a blue-ocean market, where competition is minimal and your product has the potential to become a category leader, a free-trial strategy might be more sensible. But if you’re playing in a red-ocean market with multiple competitors, a freemium strategy can be a powerful tool to quickly capture market share. In the latter scenario, customers are generally well-informed about software solutions available to solve their problem – offering a self-serve experience with a free-tier pricing plan can set you apart from the competition and fuel growth.

In Conclusion

For any PLG company, careful evaluation of free-trial and freemium pricing strategies is crucial. Neglecting freemium could leave a market gap for competitors or new entrants to emerge and exploit the opportunity. Conversely, an excessive focus on freemium might lead to giving away too much for free, failing to monetize your product’s true value-add. This delicate balance requires thorough consideration of all the discussed factors to make an informed decision.

The information contained herein is based solely on the opinion of Neeraj Agrawal and Sudhee Chilappagari and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity. The views expressed here are solely those of the author.

The information and data are as of the publication date unless otherwise noted. Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

A monthly newsletter to share new ideas, insights and introductions to help entrepreneurs grow their businesses.