Congratulations, you’ve closed your Series B round! You’ve moved beyond product market fit, are investing in your go-to market function and are now seeing repeatability in your sales motion. Now is the time to up your metrics game.

With that in mind, we created a guide to help you track useful, but lesser-known, metrics to guide your company forward. The guide includes downloadable template slides for dashboards and board decks, as well. And while this guide is aimed at Series B companies, it can also help earlier-stage think ahead and later-stage companies benchmark their progress.

Our goal is not to provide an exhaustive guide, but to highlight the critical metrics that any executive/investor could use to predict and measure the health of the company.

We’ve divided the guide into sections for functional leaders in six business areas: marketing, sales, customer success, people and HR, finance and product and development. These sections include a mix of dashboards (numbers that help you predict where your business is going, to be tracked weekly) and board deck metrics (numbers that assess your quarterly performance and communicate this to your board and investors, to be tracked quarterly).

There’s too much good stuff in each section to summarize, so instead we’ll highlight a key dashboard or board slide that too often flies under the radar.

Downloadable E-Book and Template Slides

Loading...

Loading...

Section 1: Marketing

Let’s focus here on a board slide, Demand Generation Efficiency.

Measuring marketing impact is challenging. Marketing should definitely track all the marketing stages as well as conversion ratios. But this data should sit in your appendix, not upfront.

Our recommendation is to present opportunity and pipeline data, which reflects better buying intent. This aligns sales and marketing to speak the same language and aligns the two functions.

Too much time gets spent in top-of-funnel conversions or “the engine room” of marketing, as many refer to it. Demand generation exists to feed sales members with leads. The critical metrics that sales teams are interested in are opportunities and pipeline, so we suggest you align your board narrative there. This template slide will help you accomplish that. In the full guide above, we present an alternative slide to present demand generation efficiency for companies with a strong product-led growth (PLG) motion – plus many other drill-down metrics you might be overlooking.

Section 2: Sales

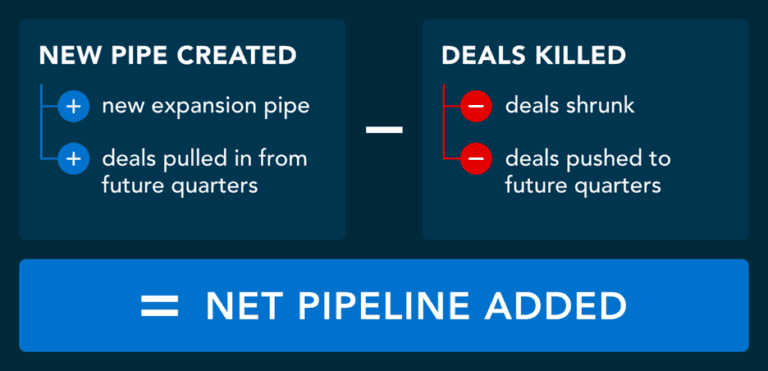

We cover a lot of ground in the full guide, but here we’ll focus on the Mojo Metric, which provides a more granular perspective on the typical pipeline views. It’s a forward-looking metric that reveals where your team is adding pipeline and how they’re moving through it. It also lets you know if your day/week efforts are resulting in positive or negative pipeline growth.

Mojo tracks six elements to give you a Net Daily Pipeline:

Pay attention to new expansion pipeline—how many NEW (not including expansion) opportunities and dollars were created for the quarter. Call this metric out and watch it every quarter. Too many teams just watch net pipe created, but this is a great metric to watch, especially for identifying marketing spend vs. new deal pipe. You’ll also want to track two different metrics with the Mojo Metric: the dollars in each of the above six categories as well as the actual number of opportunities.

Most companies track their monthly or quarterly pipeline builds, but you don’t know you’re in trouble until that month/quarter is over. The Mojo Metric allows your organization to start looking at what you need to create daily to achieve your goals.

Section 3: Customer Success

Customer success tracking starts with gross retention and NRR/NDR (net retained revenue/net dollar revenue). Another common element is to track customer sentiment, usually via customer satisfaction (CSAT) and/or net promoter score (NPS). But more and more companies are tracking customer usage patterns to assess health. There are a couple of schools of thought here, reflected in the following two frameworks:

Breadth, Depth, Frequency (BDF)

- Breadth looks at usage across the organization—if you licensed 100 seats to your customer, how many are being used?

- Depth explores the usage of your key features that create value. Are your customers consuming the core features that help them drive the most value of your product?

- Frequency goes along with breadth. Is your product used daily, weekly, or monthly?

Deployment, Engagement, Adoption, ROI (DEAR)

- Deployment: Are users ready to adopt? (consider, for example, licenses assigned or logins created)

- Engagement: Are you talking to the right executive(s) at the right cadence? (for example, VP-level interaction from your company every 90 days with your largest customers)

- Adoption: Is usage increasing in frequency (e.g., monthly active users)? Are sticky features being used?

- ROI: Is the customer seeing value? What is the proof point?

BDF and the D&A in DEAR are similar metrics, but we really like the added ROI element of determining specific points of usage in your product where value is derived by your end user. Measuring and quantifying those aha! moments and then running your quarterly business reviews (QBRs) against that is very valuable to your customer.

Section 4: People and HR

There are several actionable areas to track here, starting with your headcount demographics, recruitment stats and engagement / employee “pulse” among other areas.

For the hiring funnel, our recommendation is to track this like a marketing funnel—by stage. Every leader credits any breakout success they’ve had to people, so tracking your hiring versus plan is critical!

Once you’ve hired the team members, tracking their sentiment and satisfaction is important. We believe the old annual or quarterly review model is antiquated and suggest you instead use a sentiment tool to measure employee feelings monthly or even weekly.

Section 5: Finance

The critical feature in the finance slides is to expand on your weekly dashboards and add a longer time horizon. No one likes to dig up last quarter’s board deck and flip through the slides to find that one needed metric. Our suggestion is present your finance slides in a five-quarter view.

Though many financial slides cross over other functional areas, repeating them in the finance reel makes a lot of sense.

As a note: cross-sell and upsell refer to different figures in these slides. You may not see both activities yet at this stage of your company’s maturity, in which case you can simply combine these two rows and call it “expansion.” But as your organization matures, you’ll eventually have cross-sell (customer who purchased product A has now been cross-sold by buying product B) and upsell (customer grew from 100 units to 150 units). These are both forms of expansion and their specificity is important enough to warrant tracking them individually.

Similarly, downsell and churn are fraternal (not identical) twins. Downsell is a reduction, say from 150 units to 100 units, and churn is when a customer ceases to be a customer entirely.

Section 6: Product and Development

Traditionally, it’s been difficult to capture the performance of development teams in numbers through trackable, dashboard-type views. But that’s changing fast.

Research and development (R&D) is often the most expensive line item of the budget. Highlighting what projects are in focus, the amount of development resources committed and delivery predictability are now executive-level discussions. Transparency around delivery metrics also helps the executive team build trust in the throughput of their business. We recommend implementing a framework to share cadence, quality and costs for your R&D teams.

These metrics help you understand the cadence of your development and product organization and register the quality of your team’s work. Measuring these weekly at your staff meeting makes good sense, highlighting any anomalies to shortening/lengthening trends.

Conclusion

The goal of this guide is to help you track and measure the performance of your company’s six core functional areas: marketing, sales, customer success, people/talent, finance and product/development. We’ve constructed dashboards so you can better see emerging trends week-over-week, and we built board slides with a five-quarter view to facilitate historical comparisons.

Download the full guide now to uplevel reporting and provides greater visibility into the numbers that truly matter for your business.

The information contained above is based solely on the opinions of Bill Binch. It is material provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

The information and data are as of the publication date unless otherwise noted.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

The information above may contain projections or other forward-looking statements regarding future events or expectations. Predictions, opinions and other information discussed in this post are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Battery Ventures assumes no duty to and does not undertake to update forward-looking statements.

A monthly newsletter to share new ideas, insights and introductions to help entrepreneurs grow their businesses.