You don’t plan your household expenses with expectations of winning the lottery. Why do that in the business world? In the last few years, sales models have evolved to promote efficient growth—and yet I’d argue many models haven’t changed enough.

In the zero-interest world, SaaS sales teams were frequently built with an aggressive growth mindset. Hire more reps, deploy more quota to the street and worry less about costs.

The last two years have upended that view. Business plans evolved to balance growth against costs to achieve said growth. The new model is to build a solid growth plan but also to use formulas like the Rule of 40 and the SaaS Magic Number to measure that growth’s efficiency.

This paradigm shift impacted sales teams immediately – sales teams either got reduced or leaders ceased replacing sales reps who left, or both. Meanwhile, we saw another output: More sales reps missed quota during this period, even with fewer reps inside the business. This is a double whammy—reps being laid off and the remaining reps still missing quota… not the definition of a winning locker room.

Typically, SaaS companies plan for 60-80% of their sales reps to achieve quota in any given period. But it was common in 2022 and 2023 to see performance dip to around 10% – 35% of reps making quota in a given quarter—a big decrease from previous periods.

If we changed the model to run the business more efficiently, yet are still seeing more reps missing quota, shouldn’t we explore new quota deployment models?

A tale of two sales models

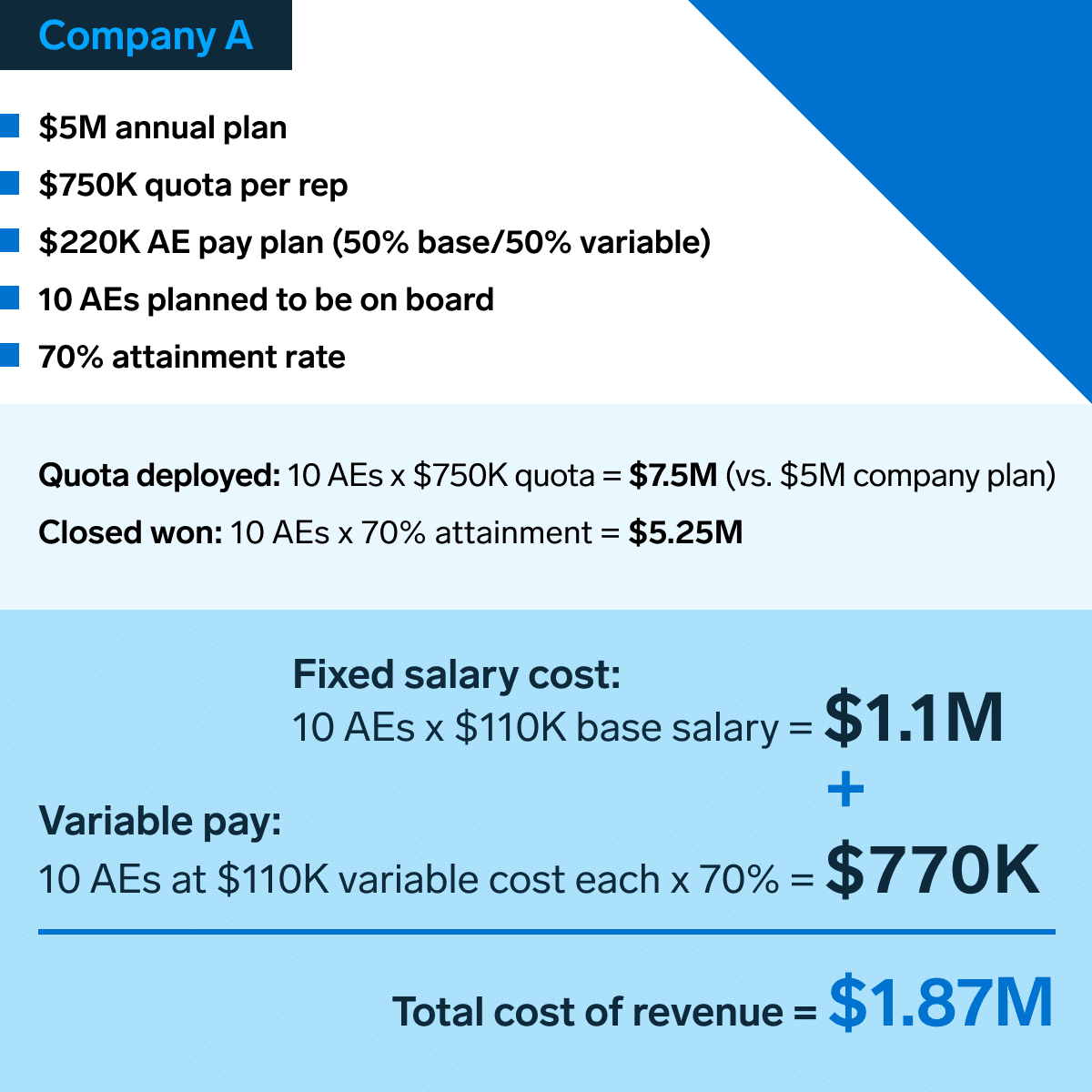

Let’s explore some fresh approaches to building the sales plan with a focus on efficiency, while creating a winning sales floor. Consider this example:

Company A achieved $5.25M in new business, and it cost just shy of $1.9M. This would be a good team to be on – lots of reps selling software and achieving high performance. But most companies in recent years have looked less like Company A and more like Company B below.

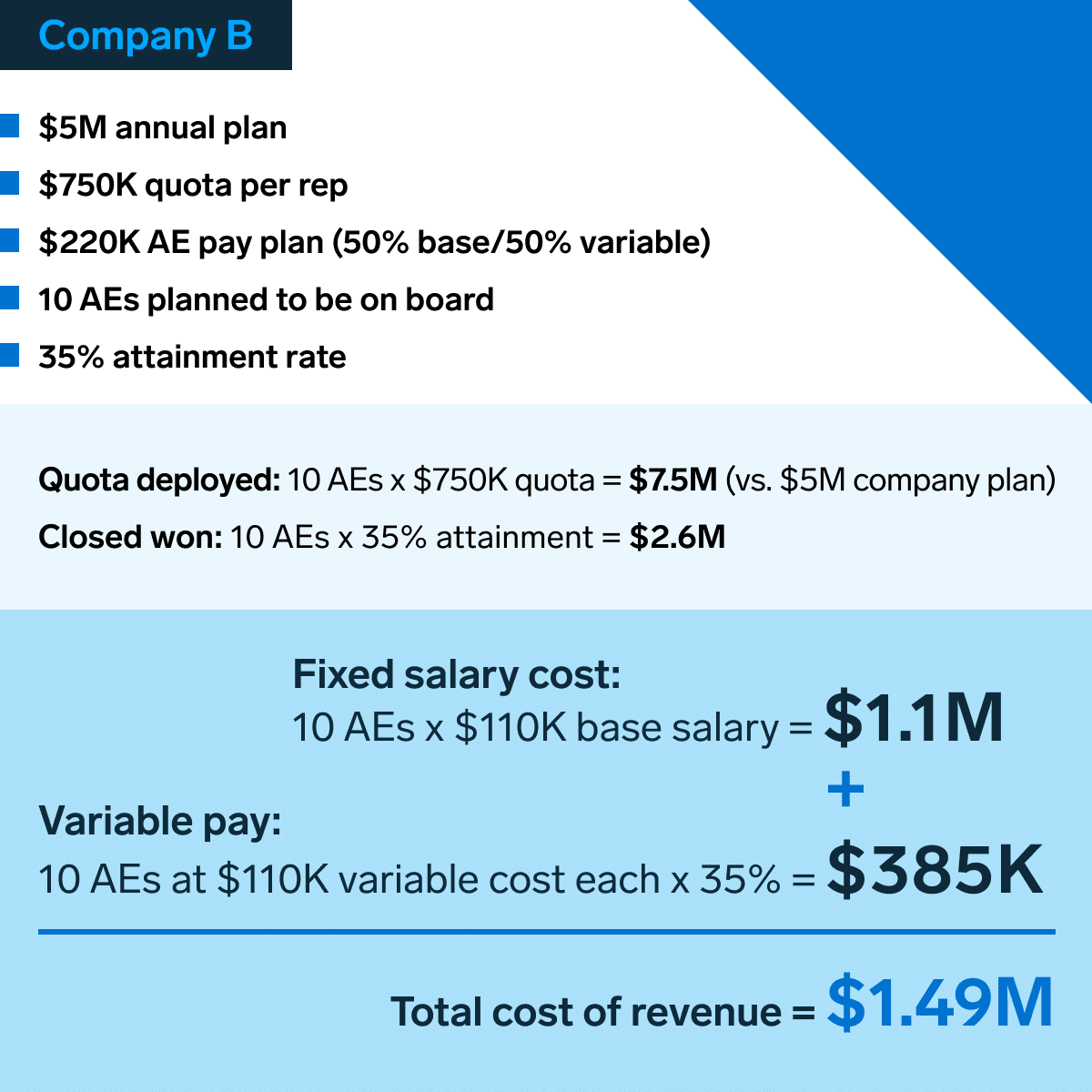

Company B produced $2.6M at a cost of $1.5M, and likely didn’t have anyone hitting their quota. Worse yet, they assigned out $7.5M of quota against a $5M plan to achieve $2.6M. No bueno – this is a low morale team.

Real talk: It’s time to right-size your sales team

So, here’s the million (or even billion) dollar question. Your company performance looks like Company B for the last 2 years. If less than 50% of your sales team is attaining quota, why are you carrying more reps (and more expense) than is necessary? You’re acting with the false hope that simply by having quota capacity deployed, you’ll somehow hit quota.

Have you considered reducing the number of reps, therefore reducing cost, while producing the same bookings and producing a “winning” feeling on the sales floor? This cuts to the heart of the issue – it absolutely sucks to lay people off. But if your company is still spending too much to support a bad plan, you need to reckon with the scoreboard.

Ask yourself this: In the last 8 quarters, how many board meetings have you confidently walked into showing a beat for last quarter’s quota and a forecast above next quarter’s plan? It’s time to get your targets set right and your achievements in positive territory. A right-sized plan is not only pragmatic in terms of cost; it also helps the rep you have on the street be successful and thus fosters a winning culture.

If you’re tempted to protest, “But I’m keeping rep capacity for when the economy gets better,” I’d reply that all indicators suggest that any improvement will be gradual. If that prediction holds true, you can always build milestones into your plans (i.e. if 75% of my reps hit quota, then I’ll hire an incremental rep) that let you re-start the hiring machine.

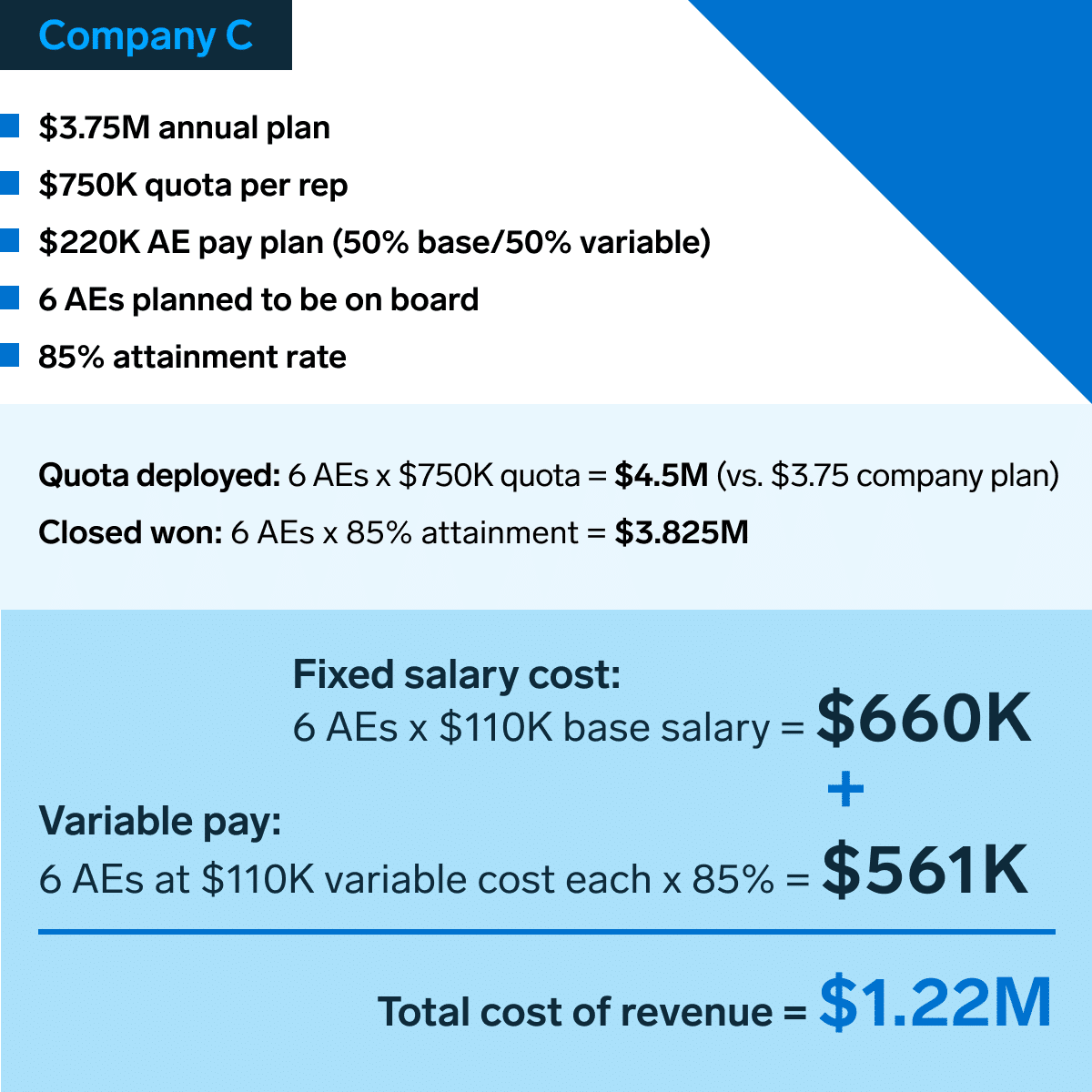

So, let’s look at Company C’s sales plan:

Company C lowered the goal to $3.75M and likewise lowered their costs by nearly $300K versus Company B. But because there is more available surface area per rep, this model showed 85% productivity producing $3.8M, which is $1.2M more than the Company B bookings at a heck of a lot lower cost. Why would Company C’s 6-member team outperform Company B’s 10-person team? Because winning is infectious… great sales leaders will recognize this phenomenon.

Let’s go further. What if this entire team outperformed their quota? What if every rep hit 110%, which would produce $825K of bookings per AE and a total of almost $5M? Assuming you paid all commission dollars at 125%, that would mean you booked $4.9M ($825K x 6) and it cost you $1.57M ($110K x 6) + (6 x $110K x 1.1 x 1.25).

Optimize for AE attainment rate–and watch success beget success

I’d argue it’s time to start exploring how to deploy quota to the street. Consider moving away from the traditional “insurance plan” of 20-30% over-assignment of street quota to company plan, and instead optimize for AE attainment rate. It’s worth repeating but winning is infectious. Most sales leaders have witnessed how success begets success.

One final note: All the examples above are just theoretical models and are therefore imperfect. Company C’s model still has risk–if even one rep quits, it throws the whole model off. It’s also worth noting that all quotas were kept constant in the three examples. Adjusting quota itself might be another area to explore based on the last 24 months of actual performance.

Bottom line, I wrote this post to ask thought-provoking questions. If what we’ve been doing for the last 24 months hasn’t yielded the results we want and has created lower morale in the sales team, then it’s worth revisiting the plan’s framework. Happy modeling!

The information contained herein is based solely on the opinion of Bill Binch and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

The information and data are as of the publication date unless otherwise noted. Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

A monthly newsletter to share new ideas, insights and introductions to help entrepreneurs grow their businesses.